How to Win in 2014 Part II: 5 Strategies to Set the Stage for Success

Today’s article is written by Axial’s Inbound Marketing Manager and former investment banker and private equity professional Kateri Zhu, and marks the second installment in our series on planning for a successful 2014. Part I is a downloadable business development goal setting template. Part II, today’s installment, walks through how to build the foundation for a record-setting year.

What do top performing deal professionals do differently? They walk into each year with a deliberate and detailed plan of action. Effective planning is critical and must be done before the year starts, otherwise you’re winging it.

Whether you’re a fund manager targeting a certain return on investment or an investment banker focused on growing advisory revenues, it all comes back to having a strong deal or client pipeline. And as we covered in our first piece, in order to build a robust pipe you need a solid business development game plan (see Exhibit A below for a snapshot of our downloadable excel template).

Exhibit A: Downloadable Business Development Goal Setting Template

Download our Proprietary Business Development Goal Setting Template

However, let’s say you already go through a business development goal setting process every year. How, then, do you gain an edge on your competitors? Through our exposure to thousands of active business development professionals on the Axial network, we’ve seen five consistent themes.

1. They define specific objectives.

When constructing your goals you need to be as targeted, clear, and actionable as possible. “Build a robust transaction pipeline” is a commendable mission but how is your team going to get there? If you were to hand the plan to your associate what would he do? On the other hand, “increase conversations with intermediaries specializing in middle-market industrial companies” is a truly actionable goal. The first thing your associate would probably do is start reviewing advisors in the space, and for every bank and broker with which he engages, you get one step closer to your desired pipeline of high-return deals.

2. They focus on intermediate actions.

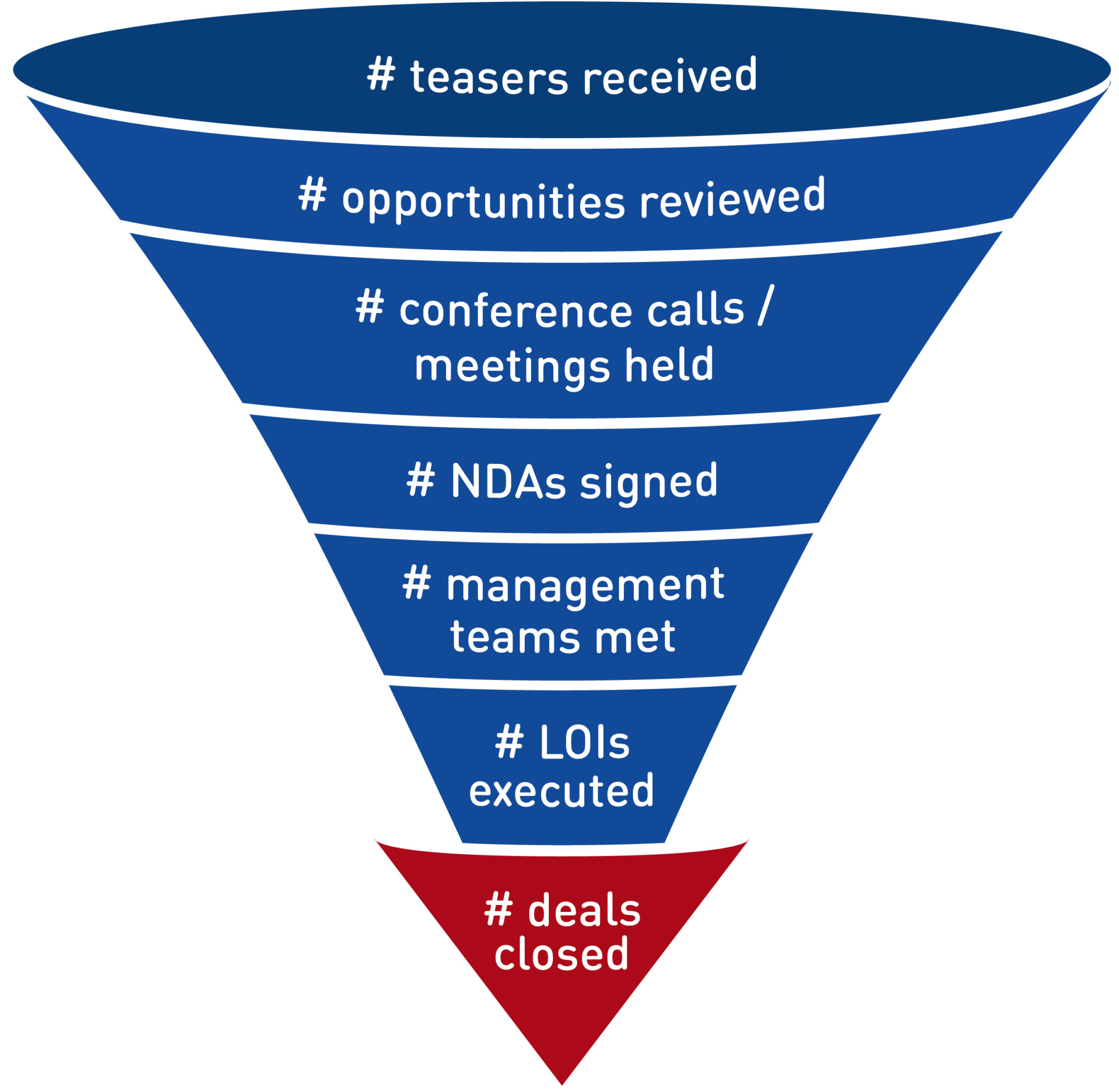

Of course at the end of the day we all want deals: deal revenue if you’re an advisor, deal returns if you’re an investor. Your 2014 plan probably already includes targets for # of transactions, $ revenue, % IRR. But what’s going to get you to the finish line this year? Rather than getting distracted by your primary performance metric, focus first on setting targets around the activities your team needs to perform to reach the topline goal:

- # new clients approached

- # pitches given

- # mandates won

- # NDAs executed

- # teasers / CIMs received

- # proprietary investment opportunities sourced

- # potential transactions analyzed

- # company owners contacted

- # LOIs executed

- # deals closed, etc.

Lucky for you, section two of our business development template includes a list of metrics that every advisor and capital provider should have in their 2014 gameplan. Read on, and then apply the tips in this article as you construct your own gameplan.

3. They set measurable outcomes.

Many investment banks want to “improve relationships with strategic and financial buyers.” While this is a goal, it’s not a trackable goal. If you ended last year with 30 relationships and added 1 more in January, you technically met your target. But if you switch it up to read “increase number of relationships with strategic and financial buyers by 25%” suddenly you have something very different.

Goals must be written down and accompanied by measurable results that serve as leading indicators of success against desired outcomes. Relentlessly choosing to set a quantified target for every single goal enables you not only to have defined goals, but to track your progress from quarter to quarter, month to month, week to week. The highest performing fund managers, bankers, and company owners track their day-to-day performance metrics religiously. The moment they start falling short of their forecasted plan, they’re already devising a counter strategy (e.g., dedicate two days to sourcing, attend an adjacent industry conference, reach out to stale clients, etc.) to get back on track.

4. They analyze sourcing channels.

This one is important. As we covered above, succeeding as a deal professional really comes down to having more high quality deals: more deal mandates for an advisor and higher deal returns for a capital provider. However there are several ways to accomplish this. Take the time to think through your channels, define them, and measure their efficacy at driving desired outcomes. Let’s say that, currently, 70% of your engagements come from legacy client relationships. However what happens when you hit a rough patch?

Knowing your channels and maintaining a certain degree of diversification is what takes you from a sticky situation to a knockout year. The most productive directors diversify across multiple channels: existing banker relationships, platform technologies, conferences, etc. (see Exhibit B). Those with their goals spread across channels (a) give themselves more opportunities to beat targets and (b) have a plan B, C, and D before it becomes necessary.

Exhibit B: Sample Channel Efficacy Tracking Template

5. They benchmark relative to the market.

Finally, keep an eye on what your goals imply. As much as we hate to face it, comparables are just as important for deal professionals as it is for our transactions. What does it mean for you to achieve an IRR of 10%, if every other fund in the space is hitting 15%? Does it ultimately help Goldman Sachs to increase their meetings with new prospects by 12%, if Morgan Stanley increased them by 30%? As with anything in the markets, one weak year is perhaps insignificant but repeat subpar performance for a couple years, and you’re in cyclical decline.

To help with this, the second section of our template combines your current results with an analysis of both sellside and buyside transaction activity growth our network to help determine your recommended 2014 targets. Use these as a starting point if you’re having trouble setting numbers.

We built this free excel template to enable you to execute your annual business development goal setting like the smartest deal professionals. It will allow you to define targeted, specific, measurable goals and determine actionable channels for execution. Download the template, follow the strategies in this piece, and get ready to hit 2014 running.